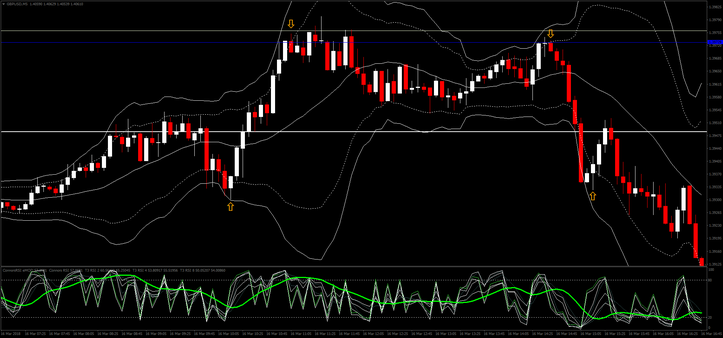

245# Fast RSI with Double Bands

Bollinger Bands reversal trend strategy

Connors RSI with T3 RSI

Submit by Frank

Fast RSI with Double Bands is an strategy inspired by a classic trading system based on two Bollinger Bands and RSI, but the differences are the different setting of the Bollinger Bands and the use of Conors RSI and T3 RSI.

This template is also good for scalping and intraday trading. The martingale is suitable at this fx strategy.

Time Frame 1 min, 5 min, 15 min.

Currency pairs any, Indices and major stocks.

Expiry time binary options high/low 3-5 candles.

Metatrader 4 Indicators

Bollinger Bands (20, 2.0).

Bollinger Bands (20, 2.5 – for 5 min and 15 min time frame- 20, 3.0 for 1 min time frame).

Support and resistance line with zone S/R.

Connors RSI mod period 3, up dawn period 2, ROC 100 period.

Connors RSI period 3, up dawn period 2, ROC 100 period.

T3 RSI (2, 2, 0.618).

T3 RSI (4, 4, 0.618).

T3 RSI (8, 8, 0.618).

Trading rules Fast RSI with Double Bands

Buy

When the price breaks the lower Bollinger Bands (20, 3.0 or 2.5) wait the price come back and It' s below the fast Bollinger Bands (20, 2.0), at the same time the RSI lines are below 20 level and after crosses upward green line.

Place initial stop loss 3 pips below the lower Bollinger Bands.

Profit Target at the middle band or fast profit that depends by pairs and time frame.

Sell

When the price breaks the upper Bollinger Bands (20, 3.0 or 2.5) wait the price come back and It' s above the fast Bollinger Bands (20, 2.0), at the same time the RSI lines are above 80 level and after crosses downward green line.

Place initial stop loss 3 pips above the upper Bollinger Bands.

Profit Target at the middle band or fast profit that depends by pairs and time frame.

In the pictures Fast RSI with Double Bands in action.

Share your opinion, can help everyone to understand the forex strategy.