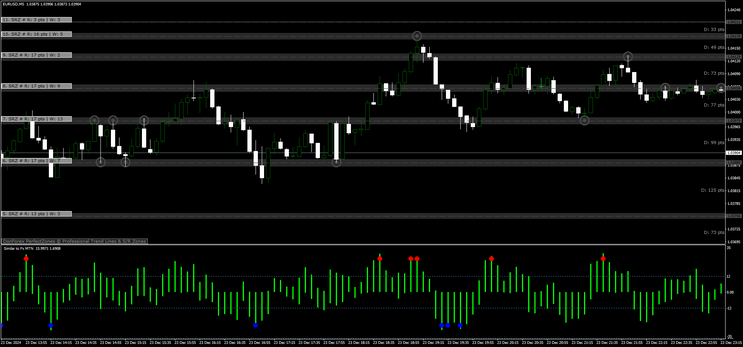

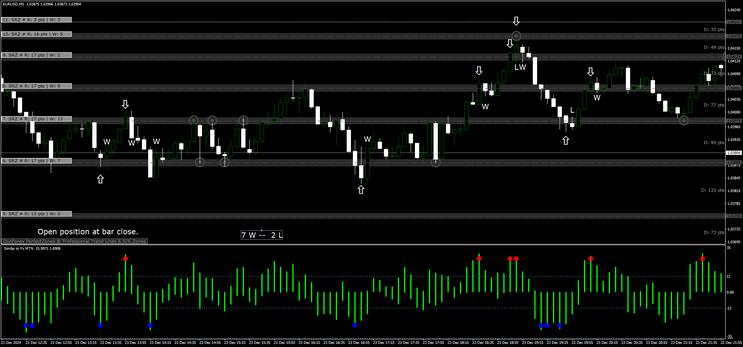

210# Forex MTN with Support and Resistance

Reversal Trading method ffor binary options

Submit by Maximo Trader update 2024

Overview

The Forex MTN with Support and Resistance strategy is a straightforward method for trading forex markets, applicable to binary options or standard forex trading. It leverages price bounces on

support and resistance (SR) levels, filtered using the Forex MTN indicator.

Setup

-

Time Frame: 15 minutes or higher.

-

Indicators:

-

Support and Resistance Indicator

-

Forex MTN Indicator with Levels +12 and -12

-

-

Currency Pairs: Any major or cross pairs.

-

Expiry Time (for Binary Options): 1 candle.

-

Note Place the dfxperfectzones.key file into the files folder.

Trading Rules

Buy (Long) Setup

-

Price bounces off a support level as indicated by the SR indicator.

-

A blue dot appears on the Forex MTN indicator, with the line below the -12 level.

Sell (Short) Setup

-

Price bounces off a resistance level as indicated by the SR indicator.

-

A red dot appears on the Forex MTN indicator, with the line above the +12 level.

Note: This system provides limited signals, so monitoring multiple charts across different time frames can increase opportunities.

Money Management D’Alembert

The D’Alembert is a negative progression system, meaning you adjust your trade size based on whether the previous trade was a win or a loss. The aim is to manage risk while attempting to recover losses incrementally.

Example of D’Alembert in Trading

Assume you start with a $100 base trade size:

-

Trade 1: Loss → Increase trade size to $200.

-

Trade 2: Loss → Increase trade size to $300.

-

Trade 3: Win → Decrease trade size to $200.

-

Trade 4: Win → Decrease trade size to $100 (base size).

This gradual adjustment minimizes the impact of losing streaks while capitalizing on winning streaks.

How the D’Alembert System Works

-

Starting Point:

-

Begin with a fixed base unit size for your trades (e.g., 1% of your account or a specific monetary value).

-

-

After a Loss:

-

Increase the trade size by 1 unit. This adjustment is designed to recover the loss gradually without significant risk escalation.

-

-

After a Win:

-

Decrease the trade size by 1 unit. This helps lock in profits while reducing exposure as your balance grows.

-

-

Reset Point:

-

Return to the base unit size once you’ve recovered previous losses or after a predefined profit target is reached.

-

Disadvantages of the D’Alembert System

-

Limited Recovery Speed: Recovering losses takes longer compared to more aggressive systems.

-

Drawdowns: Prolonged losing streaks can still lead to significant drawdowns if not managed properly.

-

Fixed Unit Flaws: Fails to account for market volatility or changing account balances dynamically.

-

Advantages of the D’Alembert System

-

-

Simplicity: Easy to understand and implement.

-

Controlled Risk: Limits rapid escalation of trade sizes compared to other progression systems like Martingale.

-

Stability: Designed for incremental recovery of losses.

Key Recommendations

-

Risk Management: Define a maximum trade size to avoid excessive losses during prolonged losing streaks.

-

Adapt Units: Adjust the base unit periodically to reflect changes in account equity.

-

Combine with Strategy: Use D’Alembert alongside a robust trading strategy to maximize effectiveness.

By following these principles, the D’Alembert system can serve as a disciplined framework for managing trade sizes and mitigating risk.

Exit Rules for Non-Binary Trading

Stop Loss Placement

-

Set the initial stop loss 4-5 pips above/below the SR levels, depending on the trade direction.

Take Profit (Predetermined Targets)

Profit targets vary by currency pair and time frame. Here are suggested targets:

-

EUR/USD

-

15 min: 9 pips

-

30 min: 12 pips

-

-

GBP/USD

-

15 min: 12 pips

-

30 min: 15 pips

-

60 min: 20 pips

-

-

USD/CAD

-

15 min: 12 pips

-

30 min: 15 pips

-

60 min: 20 pips

-

-

USD/JPY

-

15 min: 12 pips

-

30 min: 15 pips

-

60 min: 20 pips

-

Additional Notes

-

The strategy includes other MT4 indicators for support and resistance, which can be tested to enhance performance.

-

This system is simple but effective, especially when focusing on pairs and time frames with consistent volatility.

Recommendation: Always test the strategy on a demo account before using it with real funds to ensure it aligns with your trading style and risk tolerance.

watson obe (Wednesday, 27 October 2021 23:31)

I am an MTN customer, I am interested in it fx tradeing

Henry Uzoma Akubuiro (Tuesday, 19 November 2019 10:42)

i need it

Andrey (Saturday, 06 July 2019 19:57)

Support and Resistance dots appears after 3rd bar. Totaly usless.