204# Antibreakout Trading System

Reversal Scalping on Support and Resistance

Submit by Janus Trader 05/2017

Antibreakout Trading System is a strategy reversal based on the bounce of the price on support and resistance.

In this case support and resistance are created with 1-2-3 indicator.

Time Frame 1 min or higher.

Currency pairs EUR/USD, GBP/USD, USD/JPY, USD/CHF, AUD/USD, GBP/JPY, Imdices: S&P 500, Dow, DAX, FTSE.

Binary options High/low expiry time 3 -4 candles.

This system can be used also for scalping and day trading. This trading method was inspired by the Scalping Box strategy posted by Forexcube on Forex Factory.

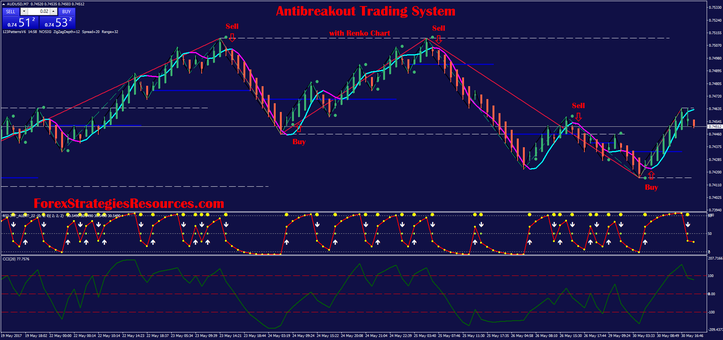

Renko chart box size 4 pips or higher.

Metatrader Indicators:

Zig Zag 12, 5, 3

123 Paternd V.6,

Daily open line,

Zig Zag 5, 5, 3,

PBF Fast MA,

1a dot,

Heiken Ashi,

NB-Channel,

RSI 3TF alert,

CCI 20 period.

Trading Rules Antibreakout Trading System

Buy or Call

When is formed the support dot wait the following conditions for entry:

CCI (20) is above 100 level (optional);

RSI below 30 level;

Heiken Ashi green bar;

Zig Zags pointing upward;

PBF Fast MA aqua color;

1a buy dot.

Sell or Put

When is formed the resistance dot wait the following conditions for entry:

CCI (20) is below -100 level;

RSI above 70 level (optional);

Heiken Ashi red bar;

Zig Zags pointing downward;

PBF Fast MA pink color;

1a sell dot.

Exit position for scalping and day trading.

Predeterminated fast profit target. Place initial stop loss above/below the SR lines.

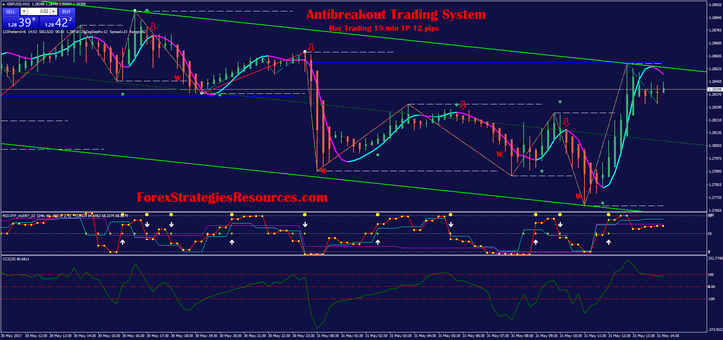

If you trading at 1 min chart is recommended to trade in the direction of the regression channel.

This is strategy that wins the comparison with commercial strategies.

Happy Trading!!

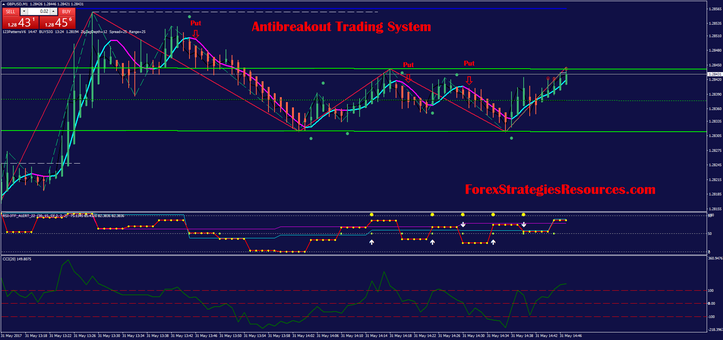

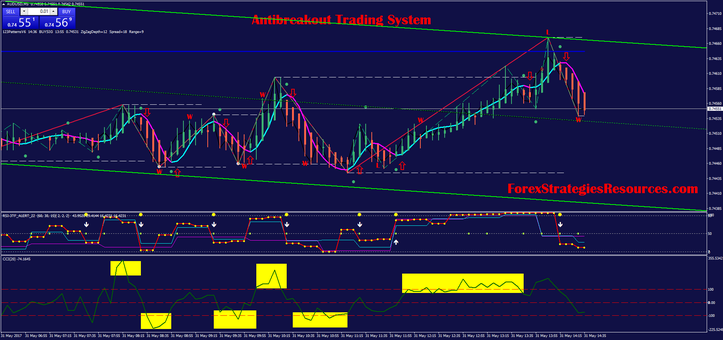

In the pictures Antibreakout Trading System in action.

Write a comment