178# Double Bollinger Bands Breakout

Double Bollinger Bands Breakout trading

Submit by Timmy 27/01/2016

Double Bollinger Bands Breakout is a method of trading trend following. This system is for intraday trading but also for swing trading, but here we applied this method for trading with binary options high/low.

Time Frame 15 min or higher.

Financial markets: any.

Expiry time 3 candle whit high volatility or a good trending market

with a weak trending market expiry time is 5 candles..

Indicators:

Bollinger bands (20, 1);

Bollinger bands (20, 2);

MACD (12, 26, 9);

optional filters

Squeeze break

expiry time with green bar 3 candles, expiry time with red bar 5 candles.

Trading rules Double Bollinger Bands Breakout

Buy

Wait for one of the candlesticks to close above the Bollinger Bands (20 , 1) upper band and at the same time the two previous candles (bars) are closed right below the Bollinger Bands (20: 1) upper band.

MACD > 0 aqua color.

Sell

Wait for one of the candlesticks to close below the Bollinger Bands (20 , 1) lower band and at the same time the two previous candles (bars) are closed right above the Bollinger Bands (20: 1) lower band.

MACD > 0 aqua color.

Exit position

Make profit with ratio 1.3 stop loss.

Place initial stop loss 2 pips above/below the middle band.

Do not trades when the prices is squeeze into the bands.

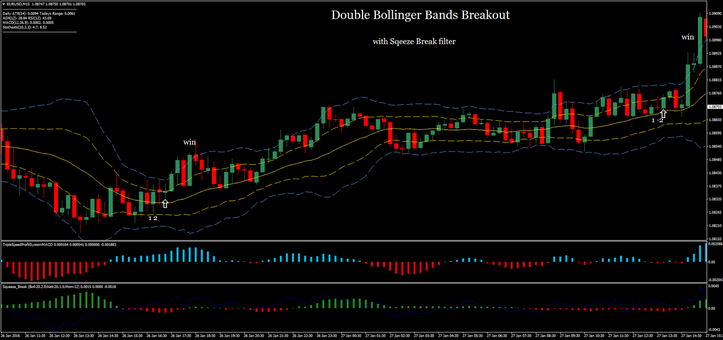

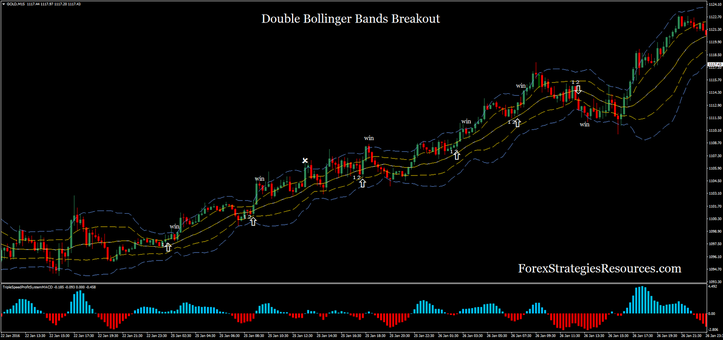

In the pictures Double Bollinger Bands Breakout in action.

Share your opinion, can help everyone to understand the forex strategy

Russel (Sunday, 16 June 2019 20:52)

Great profittability low risk.