90# Levels Trading with Arrows

Trend Momentum Strategy

Submit by Dimitri Written by Russ Horn

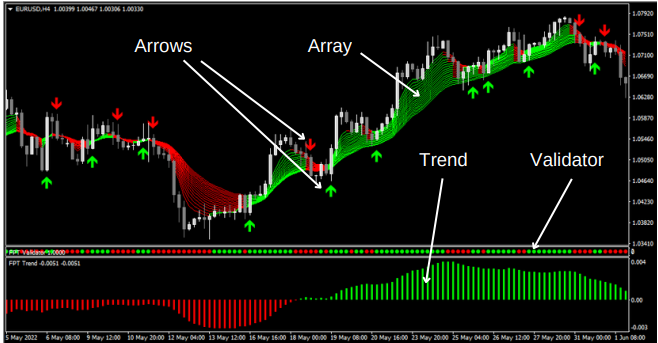

Level Trading with Arrows is a trend momentum trading system using four customized MT4 indicators.

Indicators:

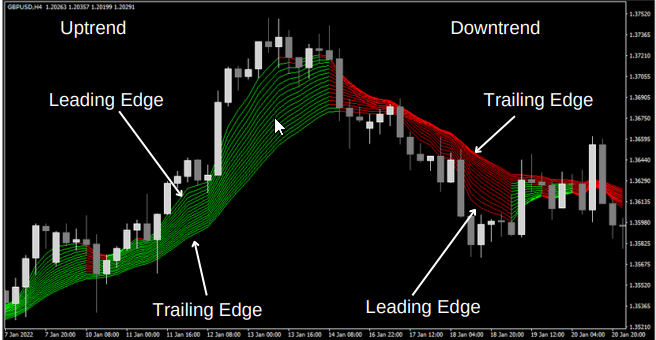

1. Array: The primary indicator based on a guppy of moving averages. It indicates trade direction and provides entry signals.

2. Arrows Indicate entry signals.

3. Trend: Shows trade direction. Green for buy trades, red for sell trades.

4. Validator: Confirms the arrow signal by matching its color.

Time Frame:

- 5 minutes or higher.

Currency Pairs:

- Volatile pairs.

Trading Rules:

Buy Trades

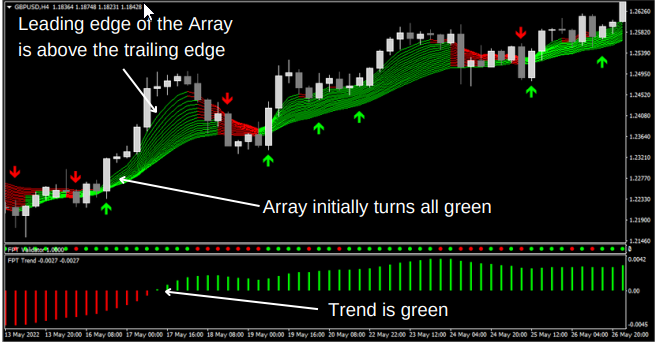

1. Identify an Uptrend

- The Trend indicator is green.

- The Array indicator is fully green, with the leading edge above the trailing edge.

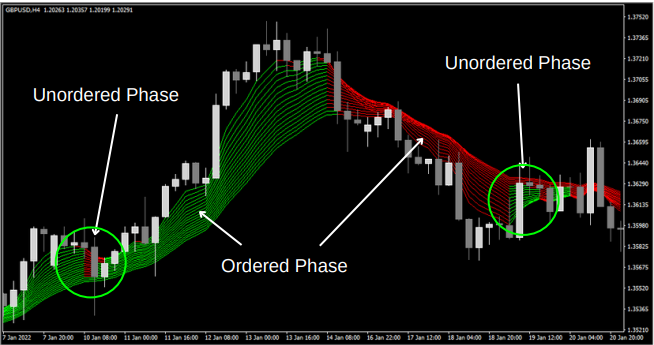

2. Look for a Pullback

- The price drops below the leading edge of the Array, turning it partially red.

3. Signal

- A candle closes above the Array, turning it fully green.

- A green Arrow appears below the price/Array.

- The Validator Dots are green.

4. Entry

- Enter at the close of the candle that meets all requirements: Green Trend, Green Array, Green Arrow, Green Validator Dot.

5. Stop Loss

- Place the stop loss just below the market's most recent swing low.

6. Target

- Set a target at 1:1 (the same number of pips as the stop loss).

7. Trade Management

- Once a candle closes above the entry price, trail the stop loss along the trailing edge of the Array indicator. Adjust the stop loss below the trailing edge of each new candle.

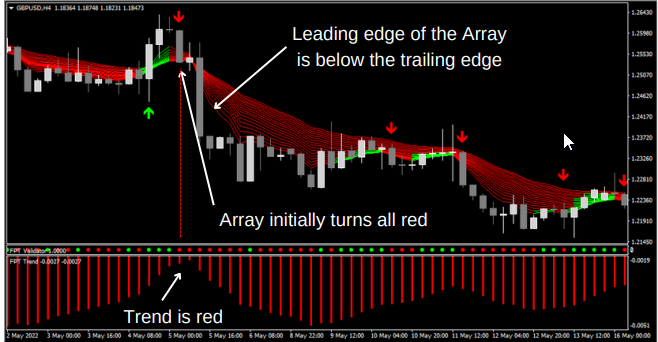

Sell Trades

1. Identify a Downtrend

- The Trend indicator is red.

- The Array indicator is fully red, with the leading edge below the trailing edge.

2. Look for a Pullback

- The price moves above the leading edge of the Array, turning it partially green.

3. Signal

- A candle closes below the Array, turning it fully red.

- A red Arrow appears above the price/Array.

- The Validator Dots are red.

4. Entry

- Enter at the close of the candle that meets all requirements: Red Trend, Red Array, Red Arrow, Red Validator Dot.

5. Stop Loss

- Place the stop loss just above the market's most recent swing high.

6. Target

- Set a target at 1:1 (the same number of pips as the stop loss).

7. Trade Management

- Once a candle closes below the entry price, trail the stop loss along the trailing edge of the Array indicator. Adjust the stop loss above the trailing edge of each new candle.

2 Sars and MACD Trading System

Submit By Janus Trader

Time Frame 5 min

Currency Pairs:

EUR/USD

GBP/USD

AUD/USD

Forex Indicator:

SAR (0.011, 0.11) – on the chart;

SMA 8 – on the forex chart;

MACD (5, 8, 9) + SAR (0.01, 0.1) on this MACD.

Long Entry

when the price is greater than 8SMA and the two SARs are in agreement.

Short Entry

when the price is less than 8SMA and the two SARs are in agreement.

Profit target:

EUR/USD 8 pips, Aud/USD 6 pips, GBP/USD 10 pips

Stop loss:

previous swing and max 12 pips.

In the picture 2 Sar and MACD forex system in action.

120# The Secret Method 2.7 - Forex Strategies - Forex Resources

11# Keltner Channels and EMA - Forex Strategies - Forex ...

60# Magic Bands: Scalping Method - Forex Strategies - Forex ...

70# Advanced RSX Scalping Strategy

111# Arktech Strategy - Forex Strategies - Forex Resources - Forex

19# Action Trade - Forex Strategies - Forex Resources - Forex ...

84# 1 min Scalping III "Profit System"