46# How to Use Dynamic Zone Step Ehlers For Winning Trading

Submit by Maximo Trader 02/2024

Dynamic Zone Step Ehlers is a complex trend following indicator whose main purpose is to eliminate the noise, i.e. the typical ups and downs of a movement of a financial instrument.

The positive aspect of this indicator is that it manages to follow a movement well, managing to eliminate a lot of noise. The downside is getting in late.

The purpose of this article is to resolve this negative aspect. The problem of late entry is solved by proposing entry on the retracement on the average price of the last bars.

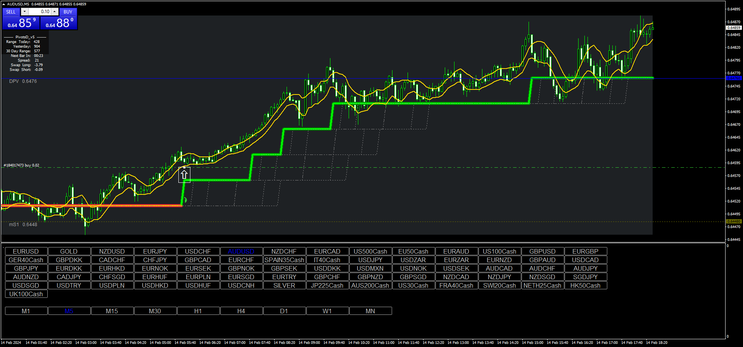

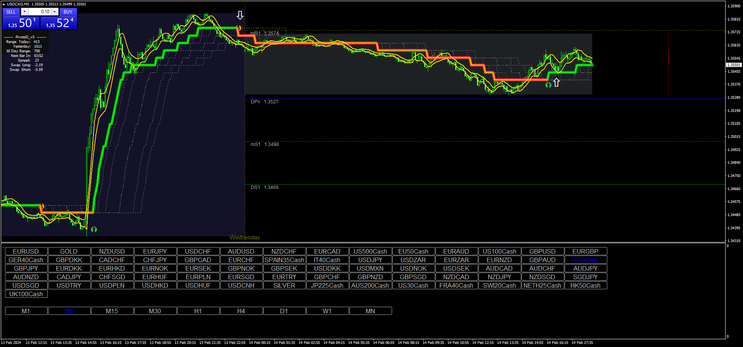

Therefore, to obtain the average price from a graphical point of view, a channel is drawn based on a simple 9-period High/Low moving average. What do you do in practice? After the appearance of the arrow signal (buy/sell) on the chart, we wait for the price to retrace to the average area of the channel to enter the market. In this way we are able to have the mathematical advantage of eliminating the noise that this indicator offers. It is underlined that the concept of entering on the average price of the last bars is a practice that no one talks about but used by successful traders who operate on high time frames, especially daily. As regards this indicator, we will make a video on how to use it because it still offers an advantage mathematical with the elimination of noise. The mathematical advantage then substantiates the possibility of applying adequate money management.

Setup Strategy

Time Frame 1 minute or longer.

Currency pairs:any.

Metatrader indicators

Dynamic Zone Step Ehlers default setting.

Simple Moving average 6 period, High,

Simple moving average, 6 period, Low.

Trading Rules

Buy

After the buy arrow appears, wait for the price to retrace into the moving average channel to enter the position. You can also enter a pending order which may also be modified.

Sell

After the sell arrow appears, wait for the price to retrace into the moving average channel to enter the position. You can also enter a pending order which may also be modified.

Profit Target on important SR levels or if day trading on pivot levels.

Stop loss on the previous swing high/low then it is used with trailing stop using the dotted lines of the indicator.

It is advisable to avoid entering after long bars.

24# Parabolic Sar Trend Scalper - Forex Strategies - Forex ...

72# CCI Explosion - Forex Strategies - Forex Resources - Forex ...

11# Keltner Channels and EMA - Forex Strategies - Forex ...

81# BBox Advanced Scalping System

60# Magic Bands: Scalping Method

35# Price Action Fractal Scalping

28# Simple Scalper - Forex Strategies - Forex Resources - Forex ...

2# Scalp with EmaPredictive - Forex Strategies - Forex Resources

98# AFX Trader - Forex Strategies - Forex Resources - Forex ...

105# Scalper Wave - Forex Strategies - Forex Resources - Forex ...

Write a comment

Maximo Trader (Wednesday, 04 September 2024 19:44)

You are right, DLL file was missing, now I updated it and it works fine.