130# 5 Minute Scalping with Machine Learning

Trend following strategy filtered by multivariate statistics.

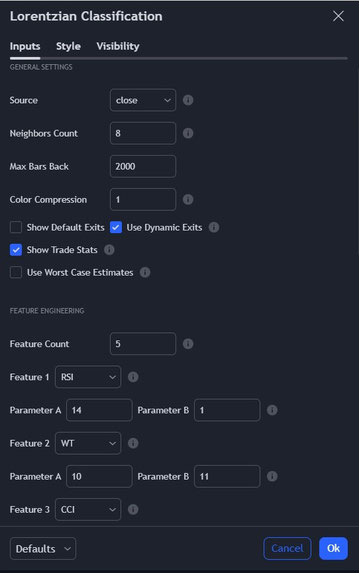

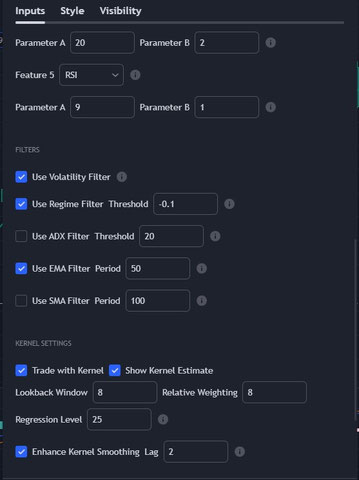

Machine Learning Lorentzian Classification

Submit By Janus Trader

5 minute scalping: with machine learning is a trend following strategy filtered by multivariate statistics. Machine learning is a multivariate statistical technique that synthesizes n° variables or improves the regression techniques, in this case we use an optimization of the regression techniques. This ANN algorithm operates on a dataset in chronological order, performing calculations every 4 bars to reduce computational load and ensure a minimum spacing of 4 bars between neighbors.

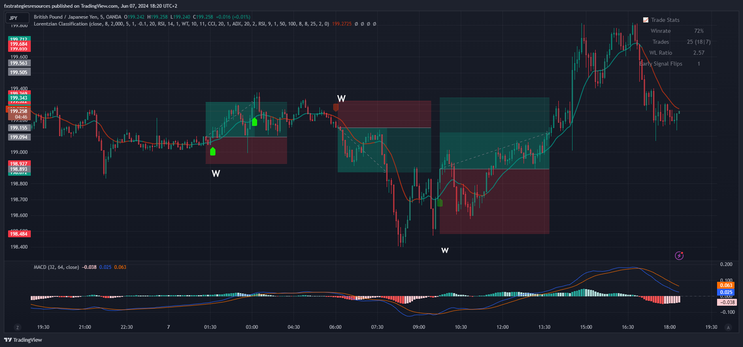

This strategy has been structured for the 5 minute time frame for very volatile instruments. In any case it should be configured for each instrument, this is just an educational example. So before trading, configure 4-5 volatile instruments with a win rate above 63%. I proposed a further trend filter, a slow MACD. See the video for more examples.

Strategy Setup

Time frame 5 minutes

Currency pairs: GBPJPY, BTCUSD, Oil, Tesla, Vix, EURAUD, AUDUSD, AUDJPY, EURJPY, NZDUSD, GBPUSD.

TradingView indicators

Machine Learning Lorentzian Classification setting: see in the pictures.

MACD has two options (32, 64, 12) and very slow (64, 128, 12). Optional because Machine Learning indicator is very filtere

Trading Rules

Buy

Machine Learning buy arrow.

MACD >0

Sell

Machine Learning sell arrow.

MACD <0

Exit position

Place initial stop loss below above the previous swing high/low.

Profit target minimum ratio stop loss 1.1:15 or trailing stop.

Conclusion

The "5 Minute Scalping: High Win Rate with Machine Learning" strategy is a trend-following approach using machine learning and multivariate statistics, optimized for highly volatile instruments

on a 5-minute timeframe. The strategy involves performing calculations every 4 bars for efficiency and ensuring sufficient spacing between neighbors. It uses a Lorentzian distance metric and

incorporates a slow MACD (32, 64, 12) as a trend filter. The strategy applies to various currency pairs and volatile assets like GBPJPY, BTCUSD, and Tesla. Trading rules include buying when a

machine learning buy arrow appears and MACD is above 0, and selling when a sell arrow appears and MACD is below 0. Exits are managed using a stop loss placed above/below the previous swing

high/low and a profit target with a minimum stop loss ratio of 1.1:15 or a trailing stop.

Write a comment

Fabiana (Sunday, 09 June 2024 18:56)

Wow, this "5 Minute Scalping: High Win Rate with Machine Learning" strategy is fascinating! The combination of Machine Learning Lorentzian Classification and Slow MACD Filters seems like a powerful approach for trend-following in volatile markets. Has anyone tried this strategy yet? Curious to hear about your results and experiences!