122# Kernel Regression Scalping Strategy

Trend following statistical approach

Submit by Janus Trader

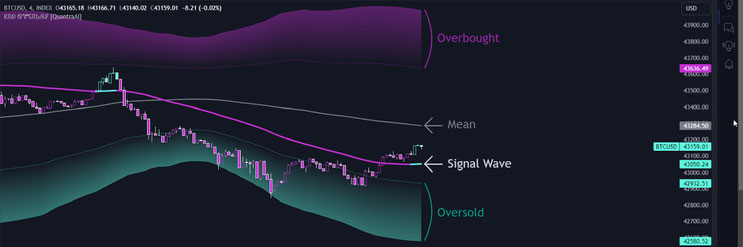

The Kernel Regression Oscillator (KRO) is a sophisticated trading tool for those looking to leverage market trends effectively. It excels at pinpointing and validating trend directions, as well as identifying dynamic and probabilistic overbought and oversold zones. This approach helps traders significantly cut down on false signals, providing a more dependable gauge of market movements compared to commonly used indicators. In this specific case we use the indicator to identify trends and therefore to trade in trends. The proposed strategy uses the characteristics that define the kernel regression trend (the central line and the wave signal) together with the MACD as further confirmation of entry timing.

Setup Strategy

Time frame 5 min and 15 min.

Currency pairs: forex, Crypto, Commodities and Stocks.

Triple Confirmation Kernel Regression: Bandwith: 75, Width: 2, SD Lookback: 150, SD Multiplier:3;

MACD (12; 26) .

Trading Rules

Buy

The price above the signal wave range and center line.

MACD >0.

Sell

The price below the signal wave range and center line.

MACD <0.

Aggressive Entry for time frame 15 min or higher.

Buy

The price above the signal wave range.

MACD>0;

The price below the signal wave range.

Sell

MACD<0;

Exit position

Minimum ratio stop loss 1:1.2.

Place initial stop loss below/above the prewious swing High/low.

In conclusion, the Kernel Regression Oscillator (KRO) combined with the MACD offers a robust strategy for identifying and trading market trends. By focusing on the 5-minute and 15-minute time frames, and applying this strategy to a variety of financial instruments such as forex, cryptocurrencies, commodities, and stocks, traders can enhance their decision-making process. The KRO's ability to define trend directions and detect overbought or oversold conditions, coupled with the MACD for confirmation, significantly reduces false signals.

Write a comment