121# Secret Weapon in Precision Trading

Trend Action Strategy

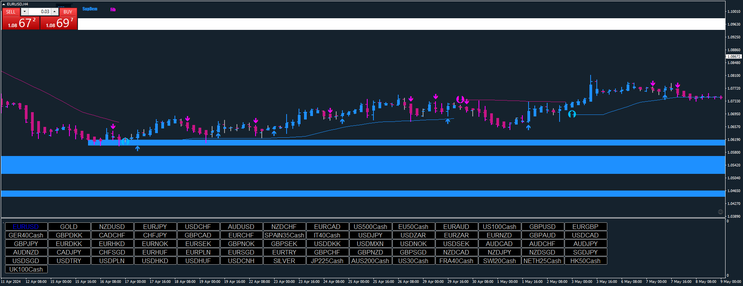

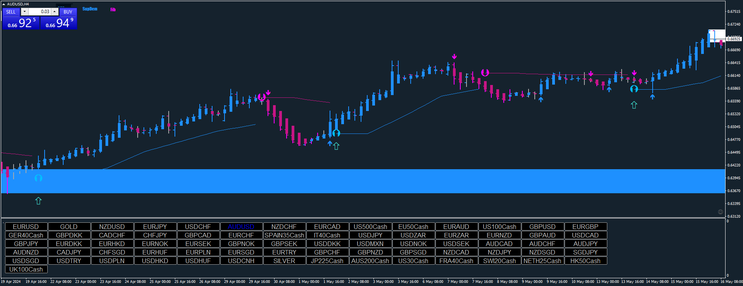

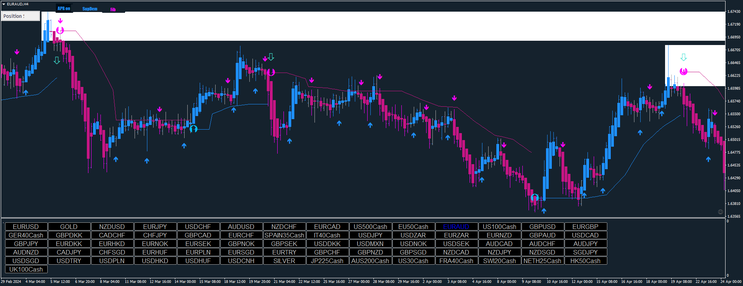

Trend Envelopes strategy

Submit by Janus Trader

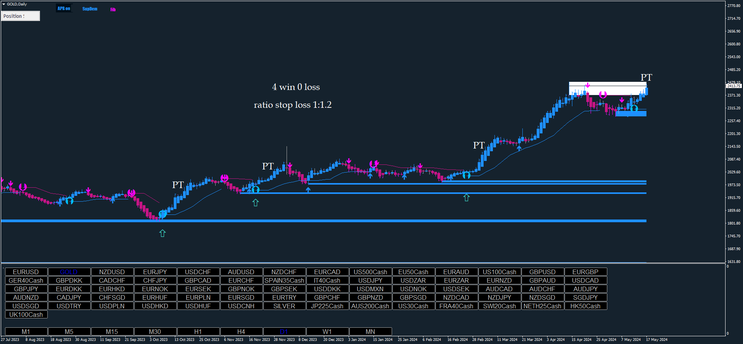

Secret Weapon In Precision Trading is a trend action strategy based on trend following indicators filtered by key levels. The strategy is provided with two models relating to different time frames. The rules are the same for the two models, the differences concern the setting of the superdem indicator and the use of the Zwinner indicator.

Setup Strategy

MT4 trading platform.

Time Frame 5 minutes or more.

Currency pairs: major minors, Nasdaq 100, Gold, BTCUSD, ETHUSD.

Metatrader 4 indicators

Symbol Changer.

TrendEnvelopes Mtf (3, 3).

Super Dem Time Frame 5-15 minutes (60), Time Frame 30, 60, 240', 1440 (1440).

Zwnner is recommended to use it as re-entry or addition of positions only at high time frames 60, 240, 1440.

APB Candles.

Trading Rules

Buy

The price bounces off the support zone.

Trend Envelopes buy arrow.

Sell

The price bounces off the resistance zone.

Trend Envelopes Sell arrow.

Exit position

stop loss on the previous swing high/low or above/below the support/resistance area.

Profit target ratio stop loss minimum 1:1.2

Note (optional) you can use Zwinner to increase the size in the direction of the trend envelopes or at time frame daily trade within the trend envelopes as filter and ratio stop loss 1:1.

Buy

Trend envelopes up trend

Zwinner buy arrow

Sell

Trend envelopes down trend

Zwinner sell arrow.

In conclusion, The Secret Weapon in Precision Trading, which combines trend-following indicators with key levels, is perfect for enhancing the precision of your trades. Whether you're day trading or using higher time frames, following these rules will help you make more informed trading decisions. Be sure to watch the example videos to see the strategy in action!

Volatility Scalp

Submit by Janus Trader (Written by Chiqho)

EA and Manual System

DEFINITION

Although I am using term “Scalp”, but this is not meaning that it’s a “pip” EA. In fact this system should be named with 20 Period MA Mean Reversion System. But let’s forget about the name, before using this EA; let’s look how it’s work.

Time Frame

This EA work at 15 M Time Frame, it uses 1 M Chart to find entry point, and using Daily Chart to filter out bad trade. Therefore make sure the EA run on 15 M Chart.

This is my template. There are several indicators there, Keltner Channels (20,2), Bollinger Bands (20,2,MedianPrice), Parabolic Sar (0.002,0.2), Average True Range(20), and there are two CK_Speed(20,50) and (5,20). No matter how much indicators there, there are only 2 period that I use, 5 for short period and 20 for my long period.

This picture show you where the EA, put its entry, and where the EA close it.

Rules:

Main rule to create the system:

As long the last bar (current bar, therefore it may repaint) and previous last bar (should not repaint) are not green color, then this is our setup to make 20 Ma Mean Reversion System. This is the only one rule that must we care to create the system. As long this condition occurred, the probability of price to hit then mean is higher, and our task to make sure from our entry before hit the mean will make profit.

The others rule that may become a filter.

In the picture volatility scalp forex system in action.

If this happen, the EA will not take any Short position again, but still to take Long position.

-

-

There are 3 places to close our position no matter how much our profit/loss. First place is the mean or MA, second is the first deviation of Keltner Channels, and the last the second deviation of Keltner Channels. The decision to close or not in each place, to be confirm with CK_Speed Indicator.

Mostly if price hit the MA in trading time, we have make profit there. If it’s not the situation, then it’s become a difficult decision to make here. To close accepting the current loss, or to hold the trade to expect the price to penetrate the first deviation even the second deviation as the final target with no reason anymore. Therefore if you have any others strategy on exit at this condition, then trade it manual, specially if trading time has been passed, but keep respect to use stop loss.

4

This picture shows such this condition. I have a Long position on red line. Meet this situation, I close my Long position when price penetrate the first deviation of Keltner Channel (White Color) and accept a loss.

The last rule in exit position, the EA only looking for profit (summing) as much as 1 pips, if trading time has been passed. Therefore try to avoid last hour trade if there are no more an open position.

What Pair to Trade

Early, I create this system to trade EURUSD pair. But a wide range on EURUSD pair since August 2008 make this system suffered a huge drawdown. A surprising result comes when I try to test on other pair. A superior result come on EURCHF pair (using 3 spread and 3.8 spread) and EURGBP(using 3 spread) in back testing using history data from Alpari (starting 2004 as they have). And also a positive result (as long as profitable) on USDCAD and GBPCHF with the same period, and without any modification both entry and exit rule.

Time Based Filter:

Because most of this condition occurs at the closing of American’s Market to Asian’s Session, this system will include a Time Based Filter.

Trade time only 22-5 GMT general for all pair. A backtest result show if EURUSD pair make more then half of it’s profit at 20-1. Just do a backtest, to find a specific time trading on each pair. On my research, do not miss any trade between 22-1 GMT.

No trade at fist 2 hours on Monday. Many surprise move here.

No trade on Friday Trade after 8 GMT.

No trade on 3 times spread period. It’s mean no trade above 20 December and first week of Year.

Daily filter:

No trade if previous Daily close above/below 2 deviation of Bollinger Bands.

You can avoid this rule to set TradeOutSideBand’s value TRUE.

No trade if current 5 Period of Daily Chart showing above MaxDayAtr.

No trade if last day range is too low. I define too low if yesterday high – yesterday low less then current 5 days ATR.

You can avoid this rule to set TradeLowRangeDay value TRUE.

Entry Rules:

Main rule and Time based filter must to be followed.

No trade outside Upper and Lower channel. If price penetrate both 2nd deviation of Keltner Channel and Bollinger Bands then no trade execute here.

Because we Buy below MA, and Sell above MA, used twice of pair spread as a minimum range between current closing price and MA for the entry. This is to filter a market that it’s range only between their spread, and also a natural filter if the spread of the pair go wide.

Compare the maximum value between twice spread and last previous (not current) 20 ATR. Witch one the maximum, this our real filter for entry. Let’s we say this is our Signal Filter.

If the range between current closing price and MA as much as our Signal Filter, look 1 M Chart for the last confirmation. We only sell when the price tick up, and buy when price tick down. Therefore use WPR(20) at 1 M chart, wait for its value below -80 to go Long, and wait for it’s value above -20 to go Short.

We do Cost Averaging use the same rule above, and use the Signal Filter as minimum range between two same open positions.

The Target and exit rule:

It is hard to explain the way to exit but this is the common rule:

The main target of this system is to make profit in pips (it can sum of profit in pips if we have more than 1 same open position) as much as our Signal Filter (That’s why we are not scalper). If we get this target before touching 3 place below, then no same position will be opened.

Forex Volatility Strategies

Volatility Forex Strategies - Forex Strategies - Forex Resources ...

14# Volatility Scalp - Forex Strategies - Forex Resources - Forex ...

2# Volatility breakout channel - Forex Strategies - Forex Resources

Volatility Metatrader Indicator - Forex Strategies - Forex Resources ...

209# Without Volatility Scalping - Forex Strategies - Forex ...

3# Volatility Double Breakout Channel - Forex Strategies - Forex ...

5# Extreme Volatility - Forex Strategies - Forex Resources - Forex ...

121# Volatility Scalp - Forex Strategies - Forex Resources - Forex

1# Parabolic and Volumes - Forex Strategies - Forex Resources ...

8# Range Market - Forex Strategies - Forex Resources - Forex ...

3# Trading Breakouts with the Camarilla Equation

Double Adptive Average True Range Profit Objectives - Forex ...