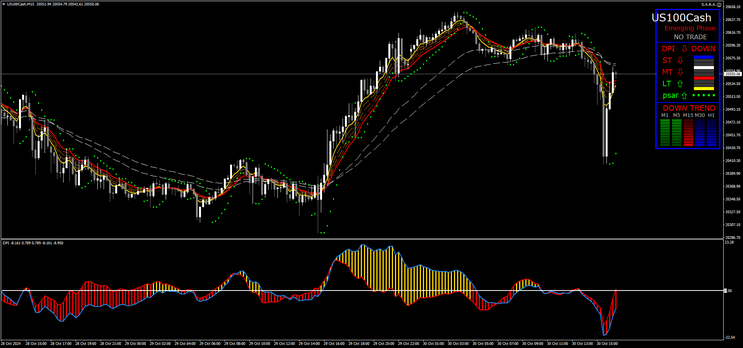

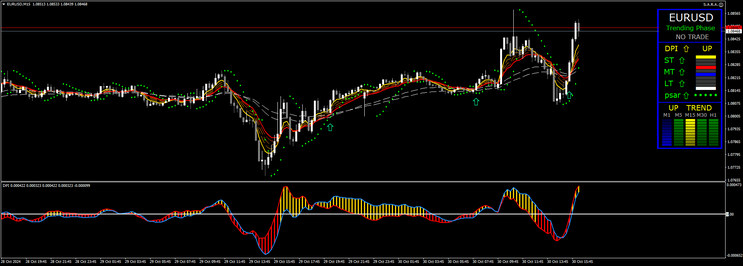

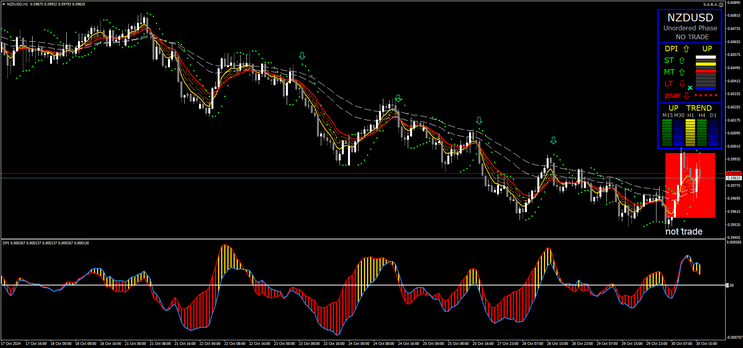

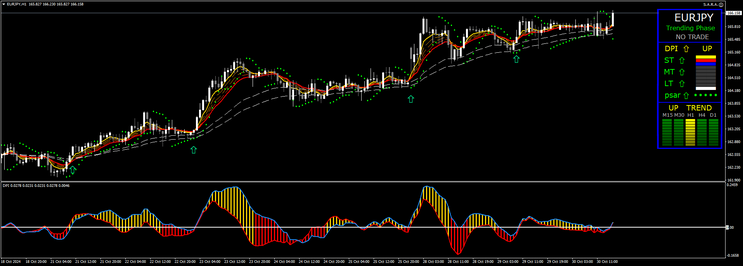

57#Nasdaq DPI Trading System

Submit by Dimitri 2024

The Nasdaq DPI Trading System is a trend-following strategy designed for volatile currency pairs, using custom indicators on the MT4 platform. This strategy aims to capture market momentum on 15-minute or higher time frames.

Required Indicators (MT4)

-

4X Bheurekso Pattern - Detects specific chart patterns (optional).

-

dff.ex4 - Measures divergence to assess momentum changes.

-

DPI.ex4 - Main trend momentum indicator.

-

Extreme_Spike - Identifies extreme price movements(optional).

-

Support Demand.ex4 - Highlights potential support and demand zones.

-

Guppy EMAs - Exponential Moving Averages (EMAs) of periods: 5, 7, 9, 11, 13, 34, 50 (all set to close).

-

Parabolic SAR (PSAR) - Parameters: (0.05-0.5) for dynamic support/resistance.

Expert Advisor

-

S.A.R.A. - An automated trading assistant for managing signals and entry/exit execution.

Trading Rules

Buy (Long) Signal

-

DPI Indicator: Expands upward, indicating bullish momentum.

-

Moving Averages (Guppy EMAs): Cross each other and trend upward, reinforcing bullish trend confirmation.

-

Parabolic SAR: Appears below the price candles, acting as a supportive signal.

-

Dashboard Confirmation: Check the dashboard for confirmation across all indicators, especially the trend status in for the selected time frame.

Sell (Short) Signal

-

DPI Indicator: Expands downward, signaling bearish momentum.

-

Moving Averages (Guppy EMAs): Cross each other and trend downward, confirming the bearish trend.

-

Parabolic SAR: Appears above the price candles, indicating resistance.

-

Dashboard Confirmation: Check the dashboard for consistency across all indicators, with focus on alignment with the downtrend.

Stop Loss and Profit Target

-

Stop Loss: Set at the recent swing high (for sell orders) or swing low (for buy orders).

-

Profit Target: Aiming for a 1:1 to 1:1.3 risk-to-reward ratio based on the stop-loss level. Adjust according to market conditions and volatility.

Additional Notes

-

Ensure that all indicator conditions align to confirm the strength of the trend before entering a trade.

-

Avoid entering trades if there are discrepancies in the indicators, especially on the dashboard.

-

Regularly monitor market conditions, as volatile pairs may require rapid adjustments to stop loss and profit targets.

37# Donchian Breakout - Forex Strategies - Forex Resources ...

Channel Metatrader Indicator - Forex Strategies - Forex Resources ...

Damiani Metatrader Indicator - Forex Strategies - Forex Resources ...

33# Commodity Channel Index Average System - Forex Strategies ...

77# Two MA Channel - Forex Strategies - Forex Resources - Forex

6# ATR Channel Breakout - Forex Strategies - Forex Resources ...

11# Keltner Channels and EMA - Forex Strategies - Forex ...

111# Mj Regression Channel and FX Sniper Ergodic CCI - Forex ...

25# Channel Strategy - Forex Strategies - Forex Resources - Forex

123# ATR Channels Strategy - Forex Strategies - Forex Resources

73# Price Action Channel, “The Gold line” - Forex Strategies - Forex ...

153# Dynamic Channel, Contrarian Strategy. - Forex Strategies ...

5# Channel Breakout and Moving Average - Forex Strategies ...

39# 5 min Channel - Forex Strategies - Forex Resources - Forex ...

26# Double Channels - Forex Strategies - Forex Resources - Forex

322# Channel 50 EMA two methods - Forex Strategies - Forex ...

10# SRDC Method Level II - Forex Strategies - Forex Resources ...

59# Scalping With I-regression